Consulting giant BDO’s most recent CFO Outlook Survey polled 100 healthcare CFOs at organizations earning at least $250 million in revenue. While the vast majority anticipate higher revenue and profitability, they add that these increases will require “strategic cost reductions and a focus on revenue cycle management.”

Standardized, efficient revenue cycle processes are a key part of cost-cutting. Inefficient RCM processes have deleterious effects on healthcare organization revenue and margins. The most pervasive and revenue-leaking flaws in the healthcare revenue cycle include:

- incomplete patient information

- coding errors

- lack of preauthorization

- untimely claim submission

- inefficient claim followup

- manual data entry errors

- delays in verifying patient insurance information

- inaccurate charge capture

- outdated billing practices

- poor documentation

Unfortunately, these issues pervade the healthcare revenue cycle.

Organizations can limit these challenges by establishing documented and efficient revenue cycle processes. Documented RCM processes serve as a roadmap for staff, ensuring consistency in operations and reducing the likelihood of costly mistakes. Moreover, they provide a foundation for continuous improvement, allowing organizations to identify bottlenecks and optimize their revenue cycle management over time.

Here, you can review how to create precise, accurate processes for your team at every point in the revenue cycle.

What are revenue cycle processes?

Revenue cycle processes in healthcare are a comprehensive series of steps that manage the financial aspects of patient care from initial contact to final payment. The cycle begins with patient access and registration, where appointments are scheduled and ends with payment posting and reconciliation.

Effective management of these revenue cycle processes ensures accurate billing, timely reimbursement, and optimal financial performance for healthcare organizations while maintaining regulatory compliance and patient satisfaction.

The 12 generally accepted RCM steps are:

- patient preregistration and scheduling

- insurance verification and eligibility

- patient intake

- charge capture, entry, and coding

- claim submission

- monitoring and auditing

- remittance processing

- payment posting

- insurance followup

- patient collections

- denial and underpayment management

- reporting and analytics

Whether documented or not, each of these steps has its own process.

Best practices for creating efficient RCM processes

To create documented, efficient processes for every step in the revenue cycle and develop a roadmap for staff, revenue cycle teams and managers should follow these best practices. While completing these tasks requires an investment of time now, it speeds training of new staff, saving significant time for years to come. This documentation can also accelerate audits. Providing solid documentation impresses the payers or government organizations scrutinizing your processes.

Develop standardized procedures

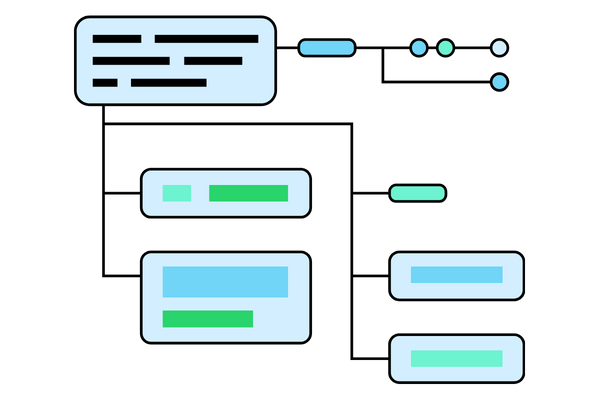

- use flow charts to map out each step of the revenue cycle in detail

- create clear, written procedures for each stage

- use flowcharts and visual aids to illustrate processes

- establish standardized workflows across departments

Implement training programs

- provide comprehensive training on revenue cycle procedures

- offer ongoing education on regulatory changes and best practices

- conduct regular refresher courses for staff

- use simulations and case studies for hands-on learning

Leverage technology

- implement robust revenue cycle management software

- utilize automation tools for repetitive tasks

- integrate systems to ensure seamless data flow

- employ analytics tools to monitor performance metrics

Establish clear communication channels

- define roles and responsibilities for each team member

- create protocols for interdepartmental communication

- schedule regular team meetings to discuss challenges and improvements

- implement a system for sharing updates and changes in procedures

Develop a comprehensive roadmap

- outline specific goals and objectives for each revenue cycle step

- set clear performance benchmarks and KPIs

- create timelines for implementing process improvements

- establish a framework for continuous evaluation and optimization

Implement quality control measures

- conduct regular audits of revenue cycle processes

- establish a system for tracking and addressing errors

- implement peer review processes for critical tasks

- use data analytics to identify trends and areas for improvement

Foster a culture of continuous improvement

- encourage staff feedback on processes and procedures

- regularly review and update documentation based on insights and changes

- recognize and reward staff contributions to process improvements

- stay informed about industry best practices and emerging technologies

By following these strategies, revenue cycle teams provide staff with a clear roadmap for consistent operations, ultimately improving financial performance and reducing errors in the revenue cycle.

Control revenue cycle processes with process mapping

Given the complexity involved in the revenue cycle’s 12 steps, keeping them all in your head is unreasonable. Instead, use “process mapping” to put these tasks on paper to relieve your responsibility.

Process mapping creates visual representations of all the tasks involved in each step in the revenue cycle. Most likely, you already are executing standard processes. Finding a way to list or diagram them so others see how it works will help you share the best protocols with staff. It also provides a way into what can be an amorphous, overwhelming responsibility.

Benefits of revenue cycle process mapping

Process mapping reflects organizational maturity, a departure from the chaotic operations characteristic of immature health systems. It demonstrates a dedication to the standardization of procedures and ongoing enhancement. Most staff would appreciate working where the following benefits exist:

- Enhanced process understanding: process maps provide a clear visual representation of workflows, helping employees grasp the entire process from start to finish.

- Improved communication: visual process maps facilitate better communication among team members and departments. They help ensure everyone understands their roles and responsibilities.

- Identification of inefficiencies: By visualizing processes, organizations can easily spot bottlenecks, redundancies, and areas for improvement.

- Standardization of work processes: process mapping helps establish consistent procedures across the organization, leading to improved quality and efficiency.

- Continuous improvement: maps serve as a baseline for measuring changes and enhancements over time, fostering a culture of ongoing optimization.

- Risk management: process mapping helps identify potential risks within operations, allowing for proactive mitigation strategies.

- Knowledge transfer: by documenting processes, organizations can preserve critical information and facilitate easier onboarding of new employees.

- Compliance assurance: process maps can serve as evidence of adherence to industry regulations and standards.

- Increased operational efficiency: by streamlining workflows and eliminating unnecessary steps, organizations can reduce costs and improve productivity.

- Enhanced decision-making: Clear process visibility enables better-informed decisions about resource allocation and process improvements.

Primary process mapping tools: the list and the flowchart

The list

Creating a simple list of all tasks involved in each revenue cycle step reflects revenue cycle management maturity.

Author, surgeon and frequent New Yorker contributor Atul Gawande has written a book on defining and documenting processes. His book The Checklist Manifesto: How to Get Things Right reveals how we all can perform at our best when we utilize checklists. Gawande shares a time in the operating room when he nicked the inferior vena cava behind a tumor with his scalpel, leading to a furious bleed. The surgeon admits that the patient would have died had the anesthesiologist not carefully followed his own checklist and brought extra blood to the operating room.

Gawande asserts that even the most talented, experienced professionals need checklists to perform optimally. The checklist ensures we keep our minds on the work in front of them. It also marshals all details involved in executing a complex job. Since the revenue cycle is a sea of details, the checklist is imperative.

We’ve compiled lists of all tasks involved in each RCM step below. You can keep them in list format or feed them into one of the AI flowchart generators we recommend below. Given the many directions a revenue cycle step can take, some organizations choose to use flowcharts to visualize their processes.

Use these tasks as a starting point. Copy and paste them into your own documents or spreadsheets. Include your organization’s unique changes and additions.

Patient preregistration and scheduling tasks

Information Gathering

1. Collect personal information:

- full name

- date of birth

- gender

- contact details

- verify patient identity - cross-reference photo ID and insurance card with the provided information

2. Gather demographic information:

- marital status

- occupation

- ethnicity

- preferred language

3. Record medical history:

- previous illnesses

- surgeries

- allergies

- current medications

4. Collect insurance details:

- insurance company name

- policy or group number

- associated identification numbers

5. Obtain necessary consents:

- treatment consent

- privacy practices acknowledgment

- HIPAA authorization

6. Create medical record:

- assign unique patient identifier

- establish electronic health record

7. Discuss financial obligations:

- explain copays, deductibles, or self-pay arrangements

- collect any upfront payments required

Insurance Verification

1. Contact the insurance provider:

- Verify policy status

- Confirm active coverage and effective dates

2. Confirm coverage details:

- Determine the scope of coverage for specific services

- Check if the provider is in-networ

3. Determine patient financial responsibility:

- Identify copayments, coinsurance amounts, deductibles

- Check out of pocket maximums

- Verify coverage limitations or exclusions

4. Check for prior authorization requirements:

- Identify services needing preapproval

- Initiate authorization process if necessary

5. Documentation and communication

- Record all information in the patient's file or electronic medical record

- Inform the patient about coverage details, financial responsibilities, and any required authorizations

6. Recheck eligibility

- Verify coverage again before service delivery to catch any recent changes

Charge capture and entry

1. Provision of medical services

2. Documentation

- Record patient information and vital signs

- Document the reason for the visit and patient's current condition

- Note the services provided, including treatments and procedures

- Record any medications administered or prescribed

- Document the patient's response to treatment

- Create a plan for future care or follow-up

- Obtain necessary signatures (provider, patient consent forms)

3. Medical coding

- Review the completed medical documentation

- Identify the diagnoses and procedures to be coded

- Assign appropriate ICD10 codes for diagnoses

- Assign CPT or HCPCS codes for procedures and services

- Ensure code specificity and accuracy

4. Charge entry

5. Verify medical necessity for the services provided

6. Review and approval

Claim Submission

1. Claims preparation

- Compile all coded information into a claim

- Verify insurance eligibility and coverage

- Submit the claim to the appropriate payer

2. Claim form generation

3. Data entry and coding

4. Claim scrubbing

5. Electronic submission

6. Tracking

7. Follow-up

Remittance processing

1. Receive remittance advice

2. Load remittance data

3. Review and reconcile

4. Process payments

5. Handle denials

6. Manage patient responsibility

7. Secondary billing

8. Analyze remittance data

9. Update accounts receivable

10. Reporting

Payment Posting

1. Review payments

2. Record payments

3. Reconcile

- Compare payments with billed charges

- Cross-check ERAs with bank deposits

- Verify payment accuracy

- Match payments to corresponding claims

4. Identify discrepancies

- Investigate reasons for mismatches

- Resolve discrepancies

- Update records with correct billing details

- Prepare reports

5. Handle denials or partial payments

6. Follow-up

7. Appeals (if necessary)

8. Balance accounts

9. Generate reports

Patient collections

Most likely you’ve already initiated eligibility, payment plans and methods during patient registration. Once treatments are complete, you embark on these steps:

1. Generation of patient bill

2. Explanation of charges

3. Patient invoicing

4. Patient communication

5. Payment collection

6. Follow-up and collection activities

Denial management

1. Identification

2. Analysis

3. Prioritization

4. Correction and resubmission

5. Appeals

6. Tracking

7. Prevention

8. Reporting and analysis

Reporting and analytics

We list over a dozen important revenue cycle reports here. Read how you can use the Revenue Leakage, Denial Analysis, Operating Margin, and many other reports to remain in control of revenue cycle costs. The steps involved in compiling these reports are:

1. Data collection

2. Data analysis

3. Forecast model selection

4. Report generation

5. Review and adjustment

With these steps documented, you and your staff can be on the same page about how to effectively manage the entire healthcare revenue cycle from start to finish.

Better, with the dozens of tasks involved in the 12 revenue cycle processes listed above written down, you no longer need to memorize them. Simply keep them handy as a reference.

The flowchart

Another option is to load them into an automated flowchart creator like AI-driven tools like Miro AI Flowchart Generator, Boardmix, ClickUp, and Lucidchart. Users can simply enter a text description of a process, and the AI generates a corresponding flowchart automatically within seconds. You can also quickly generate different versions of flowcharts to explore various options.

Types of flowcharts you can consider using for these tasks are:

- Process flowchart: illustrates the step-by-step sequence of tasks in a process, commonly used in engineering, business management, and product design.

Flowcharts make various process directions visual.

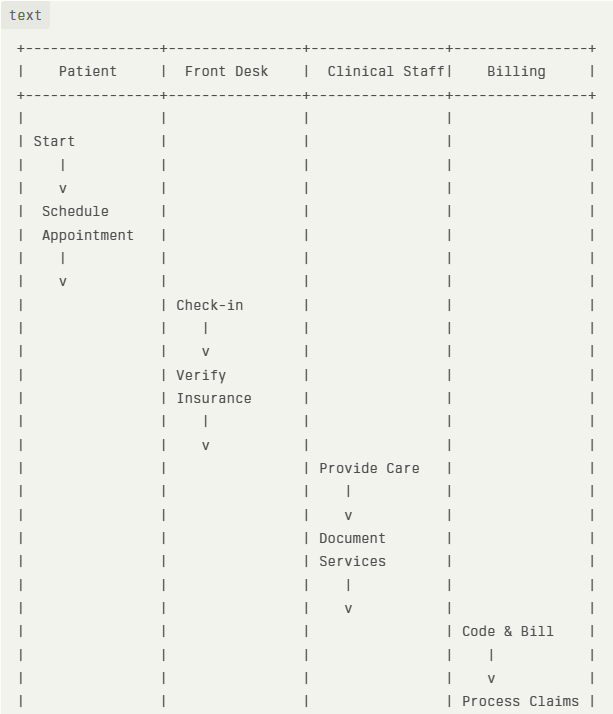

- Swimlane flowchart: shows cross-functional processes, with distinct teams or departments displayed in rows or columns, helping to visualize complex workflows across an organization.

- Data flow diagram (DFD): maps out the flow of data within a system, showing how data is processed, stored, and transmitted. Often used in computer programming and systems analysis.

- Decision flowchart: focuses on the decision-making process, outlining different paths and outcomes based on specific conditions or criteria.

- System flowchart: represents the architecture and components of a system, including hardware, software, and their interactions. Useful for designing, documenting, and troubleshooting complex systems.

By regularly reviewing and updating lists or flowcharts, healthcare organizations can continuously refine their revenue cycle management, leading to improved financial performance, reduced claim denials, and enhanced patient satisfaction.

Revenue cycle process software

RCM professionals face not only endless steps for each revenue cycle process, they also must grapple with what has become the explosion of healthcare data.

Take the patient access process.

Where once staff merely collected name, address, phone, and insurance, now they must add potential secondary insurance, patient preferences, social determinants of health, and more. This expanded data collection not only increases the complexity of the patient access process but also requires sophisticated systems to manage and utilize this information effectively for both patient care and revenue cycle management.

Robust revenue cycle management software comes preloaded with customizable process steps. It automates routine tasks such as patient registration, eligibility verification, and claim submission, all while reducing manual errors and administrative workload. It also streamlines financial reporting by consolidating data into clear, understandable reports, improving cash flow visibility and conducting payer performance monitoring. It helps departments coordinate operations and enhances healthcare revenue intelligence.

Take a quick, self-guided tour through a powerful contract performance optimization and payer underpayments identification tool:

AI and automation are increasingly supporting many revenue cycle processes. However, the level of automation varies across different tasks. Here's an overview of which processes are most likely to be supported by AI and automation, and which remain largely manual.

Processes Commonly Supported by AI and Automation

If you’re curious about where you stand among peers in revenue cycle automation, the CAQH Index measures the extent of adoption of automation of many of these processes. At this time healthcare organizations have widely adopted automated solutions for:

- Eligibility and benefit verification: the CAQH Index reports that 94% of these transactions are now conducted electronically.

- Claims submission: 98% of healthcare organizations have implemented automated claims submission processes to reduce errors and speed up reimbursement.

- Payment posting: automated payment posting is becoming more common, helping to reconcile payments with claims more efficiently.

- Claim status inquiries: 74% use automated "claim statusing" to check on outstanding claims.

On the other hand, health systems conduct the following processes mostly manually or via a semiautomated approach.

- Prior authorization: given the complexity of prior authorization processes, it’s not surprising that just 31% of healthcare organizations have turned this key process over to automation and AI. 32% use a hybrid of technology and manual processes, and 37% are still fully manual.

- Computer-assisted coding: AI-powered coding assistance is growing. A recent survey of 451 healthcare professionals conducted at the HFMA Annual Conference found that 60% of healthcare organizations either use autonomous coding or plan to.

- Denials management: interest is growing in automating denials, but many organizations still handle denials manually or with limited automation. No concrete data is available.

- Complex claims or “exceptions” processing: Claims that require additional documentation or review typically involve staff to ensure accuracy.

- Patient collections: while there's movement towards automation, many aspects of patient collections, especially for complex cases, remain manual. This lag is most likely due to the sensitivity of the task. No concrete data is available.

- Clinical documentation improvement: This area is seeing increased interest in AI applications, but many processes are still manual or semi-automated.

- Appeals processing: The complex nature of appeals often requires human intervention, making full automation challenging.

It's important to note that the level of automation can vary significantly between healthcare organizations, and the industry is continuously evolving with new AI and automation solutions being developed and implemented.

Overall, according to an MGMA Stat poll conducted last year, almost half (45%) of practice leaders revealed that they’d automated 21% to 40% of their revenue cycle. More than one in three (36%) noted they had automated less than 20% of revenue cycle operations.

Automate key revenue cycle processes with MD Clarity

A comprehensive grasp of revenue cycle processes held organization-wide ensures healthcare organizations can identify bottlenecks, streamline workflows, and implement effective strategies for improvement. By mastering each step of the revenue cycle, organizations reduce billing errors, minimize claim denials, accelerate cash flow, and ultimately enhance patient satisfaction.

Moreover, a thorough understanding of these processes allows for better integration of advanced technologies like AI and automation.

But you don’t have to tackle every revenue cycle process alone. The knowledge of key processes is engineered into MD Clarity’s RevFind. A contract management and modeling system, RevFind is designed from its foundation to identify, examine, and report on payer contract performance, underpayments, denials, and the revenue impact of proposed payer changes. Its two-way data exchange capability is rooted in a commitment to seamless system integration and interoperability. RevFind is recognized by healthcare leaders as one of the most comprehensive and accurate contract management and modeling systems available.

Get a demo to see how RevFind can streamline your contract management processes so that you can optimize revenue and reduce costs to collect.

FAQs

Get paid in full by bringing clarity to your revenue cycle

.svg)

.svg)